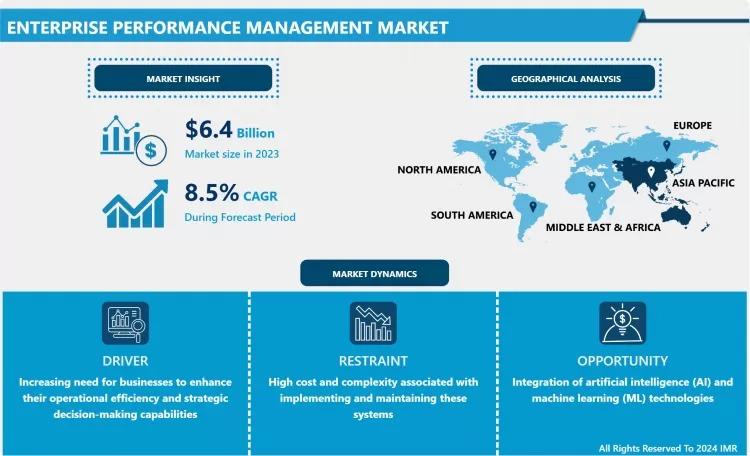

According to a new report published by Introspective Market Research, the Global Enterprise Performance Management (EPM) Market by Component, Deployment, and Application, valued at USD 6.4 Billion in 2023, is projected to reach USD 13.3 Billion by 2032, growing at a CAGR of 8.5% from 2024 to 2032. This sustained growth is driven by the increasing complexity of business operations, the need for integrated financial and operational planning, and the demand for real-time, data-driven insights to navigate economic uncertainty and drive strategic agility.

Enterprise Performance Management (EPM) comprises a suite of integrated software applications and processes that enable organizations to align strategy with execution through comprehensive planning, budgeting, forecasting, reporting, and analytics. Unlike fragmented spreadsheet-based processes, modern EPM platforms provide a unified, cloud-based framework that connects financial data with operational metrics, offering a single source of truth. This holistic approach empowers businesses to move beyond historical reporting to predictive modeling and driver-based planning, transforming the finance function into a strategic partner that can proactively guide business performance and ensure regulatory compliance.

A Key Growth Driver: The Imperative for Integrated, Agile Planning in Volatile Markets

A primary driver fueling the EPM market is the unprecedented need for business agility and integrated planning in the face of economic volatility, supply chain disruptions, and rapid market shifts. Organizations can no longer rely on static, annual budgets created in silos. They require dynamic, continuous planning that connects financial targets with operational drivers across the entire enterprise. EPM platforms enable this by providing real-time visibility into performance, facilitating collaborative forecasting, and allowing for rapid scenario modeling ("what-if" analysis). This capability is essential for proactively managing risks, reallocating resources efficiently, and capitalizing on emerging opportunities, making EPM a critical tool for resilience and strategic decision-making.

A Key Market Opportunity: The Integration of Artificial Intelligence for Predictive and Prescriptive Insights

A transformative market opportunity lies in the deep integration of Artificial Intelligence and machine learning within EPM platforms to move beyond descriptive analytics. While current systems excel at consolidation and reporting, next-generation intelligent EPM can automate complex forecasting, identify hidden patterns, and generate prescriptive recommendations. For instance, AI can enhance the accuracy of revenue predictions by analyzing internal data alongside external market signals or optimize workforce planning by modeling various hiring scenarios. Vendors that successfully embed these advanced cognitive capabilities into intuitive, user-friendly workflows will unlock tremendous value, enabling finance teams to transition from backward-looking scorekeepers to forward-looking strategic advisors who can guide the business with predictive intelligence.

The Enterprise Performance Management Market is segmented on the basis of Component, Deployment, and Application.

Deployment

The Deployment segment is further classified into On-premises and Cloud-based. Among these, the Cloud-based sub-segment accounted for the highest market share in 2023 and is expected to maintain its dominance. The shift to the cloud is driven by its lower total cost of ownership, rapid implementation cycles, effortless scalability, and seamless remote access for decentralized finance and operational teams. Cloud EPM solutions facilitate easier integration with other SaaS applications (like ERP and CRM) and ensure automatic updates, allowing organizations to focus on deriving insights rather than managing IT infrastructure. This model is particularly compelling for mid-sized enterprises seeking enterprise-grade capabilities without heavy upfront capital investment.

Application

The Application segment is further classified into Financial Planning & Budgeting, Consolidation & Reporting, Strategy Management, and Others. Among these, the Financial Planning & Budgeting sub-segment accounted for the highest market share in 2023. This application forms the foundational core of EPM, as accurate and agile financial planning is vital for organizational survival and growth. Modern solutions in this category enable driver-based and rolling forecasts, integrate operational plans, and support continuous re-forecasting. They enhance accountability, improve accuracy, and significantly reduce the time spent on the budgeting cycle, directly addressing a universal pain point for finance teams across all industries.

Some of The Leading/Active Market Players Are:

· Oracle Corporation (USA)

· SAP SE (Germany)

· IBM Corporation (USA)

· Workday, Inc. (USA)

· Anaplan, Inc. (USA)

· Adaptive Insights (USA) - A Workday Company

· Wolters Kluwer (Netherlands)

· Board International (Switzerland)

· SAS Institute Inc. (USA)

· Infor (USA)

· OneStream Software (USA)

· Vena Solutions (Canada)

· insightsoftware (USA)

· Prophix Software Inc. (Canada)

· Unit4 (Netherlands)

and other active players.

Key Industry Developments

News 1: Strategic Acquisition to Enhance AI Capabilities

In September 2024, Anaplan announced the acquisition of a specialized AI startup focused on natural language processing and predictive analytics for financial data. The acquisition aims to integrate conversational AI and automated insight generation directly into its connected planning platform.

This move reflects the competitive push to embed next-generation AI directly into core EPM workflows, allowing business users to query data and receive intelligent forecasts in plain language, thereby democratizing access to advanced analytics and reducing reliance on data scientists.

News 2: Launch of an Industry-Specific Cloud Solution

In March 2024, OneStream Software launched a pre-configured, industry-specific EPM solution for the retail and consumer goods sector. The solution includes tailored data models, workflows, and KPIs for merchandise financial planning, inventory optimization, and same-store sales analysis.

This launch highlights the market's maturation toward vertical-specific offerings that accelerate time-to-value for clients. By addressing unique industry challenges out-of-the-box, vendors can reduce implementation complexity and deliver more immediate, relevant insights to business users.

Key Findings of the Study

· The Cloud-based deployment model and Financial Planning & Budgeting application dominate global market revenue.

· North America holds the largest market share, while the Asia-Pacific region is projected to exhibit the highest CAGR, driven by digital transformation initiatives.

· Key growth is fueled by the demand for integrated planning, regulatory compliance needs, and the shift to data-driven decision-making.

· Major trends include the adoption of Extended Planning & Analysis (xP&A) and the integration of AI/ML for intelligent forecasting.

· The competitive landscape features competition between large enterprise software vendors and best-of-breed EPM specialists.