Aggiornamenti recenti

- Current Sensors for Electric Vehicles Market Shows Strong Expansion as EV Platforms Demand High-Precision Monitoring

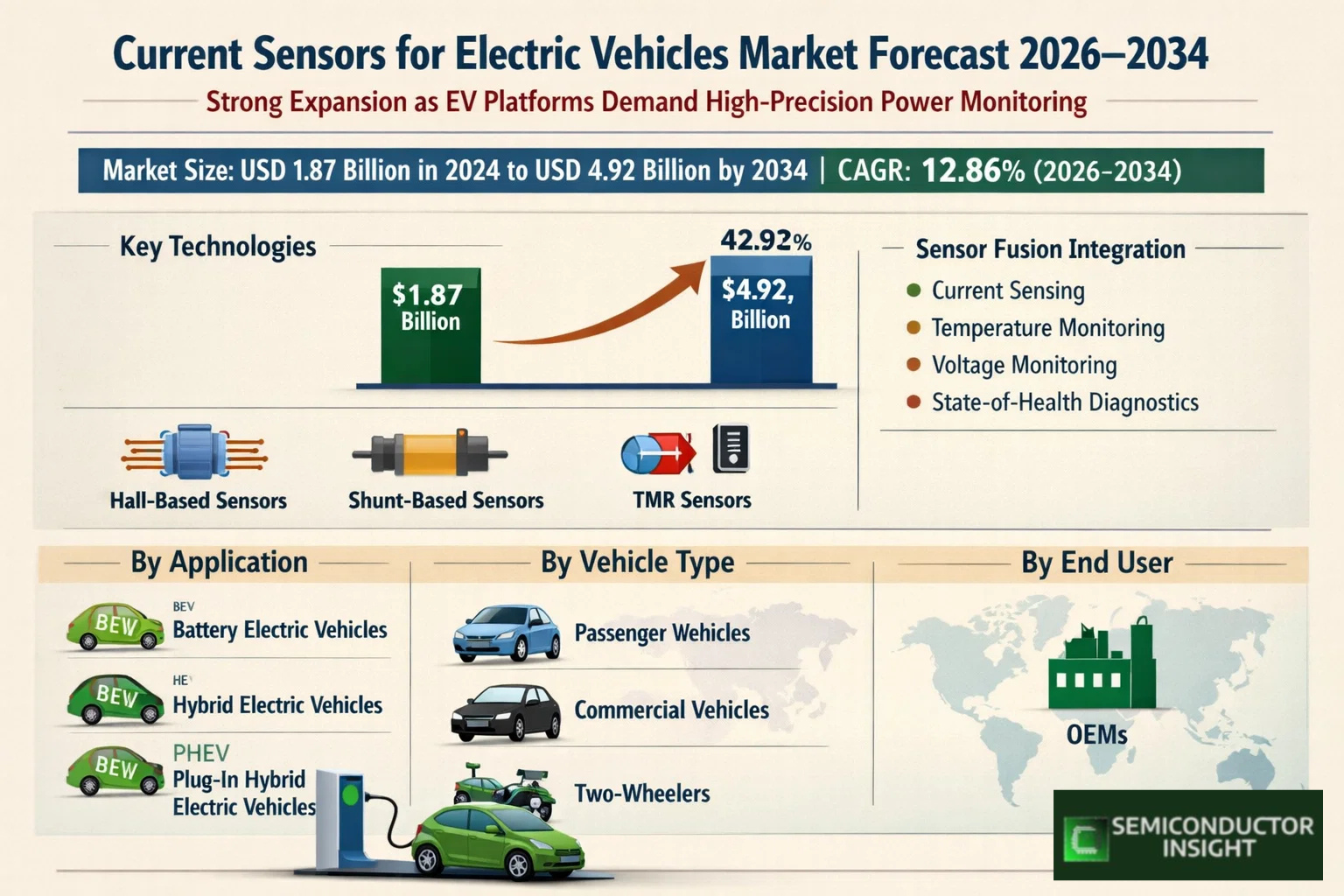

Global Current Sensors for Electric Vehicles Market was valued at USD 1.87 billion in 2024 and is projected to reach USD 4.92 billion by 2034, registering a CAGR of 12.86% during the forecast period 2026–2034. Market momentum is closely tied to accelerating electric vehicle adoption worldwide, alongside rising system complexity in battery management, motor control, and high-voltage charging architectures.

Current sensors are essential building blocks in EV electrical systems, enabling accurate measurement of current flow across battery packs, inverters, onboard chargers, and auxiliary subsystems. These sensors support performance optimization, thermal control, and functional safety. Core technologies include Hall-effect sensors, shunt-based sensors, and tunneling magnetoresistance (TMR) sensors, each offering different tradeoffs in isolation, accuracy, response time, and cost.

Electrification Scale Is Driving Sensor Content Per Vehicle

Rapid electrification across passenger and commercial vehicle segments is increasing the number of sensing points per vehicle. Battery electric and plug-in hybrid platforms require precise multi-channel current monitoring for:

• Battery management systems (BMS)

• Traction inverter control

• DC-DC converters

• Fast charging systems

• Safety and isolation monitoring

Growing EV platform voltage levels and fast-charging requirements are pushing OEMs toward higher-accuracy, faster-response, and galvanically isolated sensing solutions.

New Growth Opportunities Emerging Beyond Passenger EVs

Market opportunities are expanding beyond passenger vehicles into electric buses, trucks, and off-road equipment, where higher current ranges and rugged operating conditions require specialized sensor designs. The commercial EV segment is creating demand for reinforced, high-reliability sensing modules with extended temperature and vibration tolerance.

Vehicle-to-Grid (V2G) and bidirectional charging architectures are also opening new application areas. These systems require high-precision bidirectional current measurement with low latency, creating a premium segment for advanced sensor platforms.

Sensor fusion innovation is another value lever, with suppliers integrating:

• Current sensing

• Temperature sensing

• Voltage monitoring

• State-of-health diagnostics

into compact multi-function packages to simplify EV system design.

Segment Highlights

By Type

Hall-based current sensors lead adoption due to non-intrusive measurement and strong isolation performance.

Segments include:

• Hall-Based Current Sensor

• Shunt-Based Current Sensor

• TMR Sensor

By Application

Battery electric vehicles represent the largest share due to intensive sensing requirements within BMS and drivetrain systems.

• BEV (Battery Electric Vehicles)

• HEV (Hybrid Electric Vehicles)

• PHEV (Plug-in Hybrid Electric Vehicles)

By Vehicle Type

• Passenger Vehicles

• Commercial Vehicles

• Two-Wheelers

Passenger vehicles currently account for the largest volume, while commercial platforms show the fastest growth rate.

By End User

• OEMs

• Aftermarket

OEM integration dominates as sensors are embedded during vehicle manufacturing.

Regional Technology and Manufacturing Trends

North America and Europe show strong demand driven by safety regulations, electrification mandates, and large EV platform investments. Advanced isolation and high-accuracy sensing solutions are increasingly specified in premium EV platforms.

Asia-Pacific remains the largest production and consumption hub, supported by large-scale EV manufacturing and vertically integrated supply chains. Regional suppliers are expanding capacity and technology portfolios to support domestic OEM growth and export demand.

Key Current Sensor Companies for Electric Vehicles

• LEM Holding SA

• Allegro Microsystems

• Melexis

• TDK Micronas

• Honeywell

• Robert Bosch

• DENSO

• Continental

• Kohshin Electric

• Infineon Technologies

• Nicera

• BYD

• CRRC Corporation

• Sinomags Electrical

About Semiconductor Insight

Semiconductor Insight is a global intelligence platform delivering data-driven market insights, technology analysis, and competitive intelligence across the semiconductor and advanced electronics ecosystem. Our reports support OEMs, investors, policymakers, and industry leaders in identifying high-growth markets and strategic opportunities shaping the future of electronics.

https://semiconductorinsight.com/

LinkedIn: Follow Semiconductor Insight

International Support: +91 8087 99 2013

Current Sensors for Electric Vehicles Market Shows Strong Expansion as EV Platforms Demand High-Precision Monitoring Global Current Sensors for Electric Vehicles Market was valued at USD 1.87 billion in 2024 and is projected to reach USD 4.92 billion by 2034, registering a CAGR of 12.86% during the forecast period 2026–2034. Market momentum is closely tied to accelerating electric vehicle adoption worldwide, alongside rising system complexity in battery management, motor control, and high-voltage charging architectures. Current sensors are essential building blocks in EV electrical systems, enabling accurate measurement of current flow across battery packs, inverters, onboard chargers, and auxiliary subsystems. These sensors support performance optimization, thermal control, and functional safety. Core technologies include Hall-effect sensors, shunt-based sensors, and tunneling magnetoresistance (TMR) sensors, each offering different tradeoffs in isolation, accuracy, response time, and cost. Electrification Scale Is Driving Sensor Content Per Vehicle Rapid electrification across passenger and commercial vehicle segments is increasing the number of sensing points per vehicle. Battery electric and plug-in hybrid platforms require precise multi-channel current monitoring for: • Battery management systems (BMS) • Traction inverter control • DC-DC converters • Fast charging systems • Safety and isolation monitoring Growing EV platform voltage levels and fast-charging requirements are pushing OEMs toward higher-accuracy, faster-response, and galvanically isolated sensing solutions. New Growth Opportunities Emerging Beyond Passenger EVs Market opportunities are expanding beyond passenger vehicles into electric buses, trucks, and off-road equipment, where higher current ranges and rugged operating conditions require specialized sensor designs. The commercial EV segment is creating demand for reinforced, high-reliability sensing modules with extended temperature and vibration tolerance. Vehicle-to-Grid (V2G) and bidirectional charging architectures are also opening new application areas. These systems require high-precision bidirectional current measurement with low latency, creating a premium segment for advanced sensor platforms. Sensor fusion innovation is another value lever, with suppliers integrating: • Current sensing • Temperature sensing • Voltage monitoring • State-of-health diagnostics into compact multi-function packages to simplify EV system design. Segment Highlights By Type Hall-based current sensors lead adoption due to non-intrusive measurement and strong isolation performance. Segments include: • Hall-Based Current Sensor • Shunt-Based Current Sensor • TMR Sensor By Application Battery electric vehicles represent the largest share due to intensive sensing requirements within BMS and drivetrain systems. • BEV (Battery Electric Vehicles) • HEV (Hybrid Electric Vehicles) • PHEV (Plug-in Hybrid Electric Vehicles) By Vehicle Type • Passenger Vehicles • Commercial Vehicles • Two-Wheelers Passenger vehicles currently account for the largest volume, while commercial platforms show the fastest growth rate. By End User • OEMs • Aftermarket OEM integration dominates as sensors are embedded during vehicle manufacturing. Regional Technology and Manufacturing Trends North America and Europe show strong demand driven by safety regulations, electrification mandates, and large EV platform investments. Advanced isolation and high-accuracy sensing solutions are increasingly specified in premium EV platforms. Asia-Pacific remains the largest production and consumption hub, supported by large-scale EV manufacturing and vertically integrated supply chains. Regional suppliers are expanding capacity and technology portfolios to support domestic OEM growth and export demand. Key Current Sensor Companies for Electric Vehicles • LEM Holding SA • Allegro Microsystems • Melexis • TDK Micronas • Honeywell • Robert Bosch • DENSO • Continental • Kohshin Electric • Infineon Technologies • Nicera • BYD • CRRC Corporation • Sinomags Electrical About Semiconductor Insight Semiconductor Insight is a global intelligence platform delivering data-driven market insights, technology analysis, and competitive intelligence across the semiconductor and advanced electronics ecosystem. Our reports support OEMs, investors, policymakers, and industry leaders in identifying high-growth markets and strategic opportunities shaping the future of electronics. 🌐 https://semiconductorinsight.com/ 🔗 LinkedIn: Follow Semiconductor Insight 📞 International Support: +91 8087 99 20130 Commenti 0 condivisioni 3 ViewsEffettua l'accesso per mettere mi piace, condividere e commentare! - Bump Packaging and Testing Market Forecast 2026–2034 Shows Strong Growth

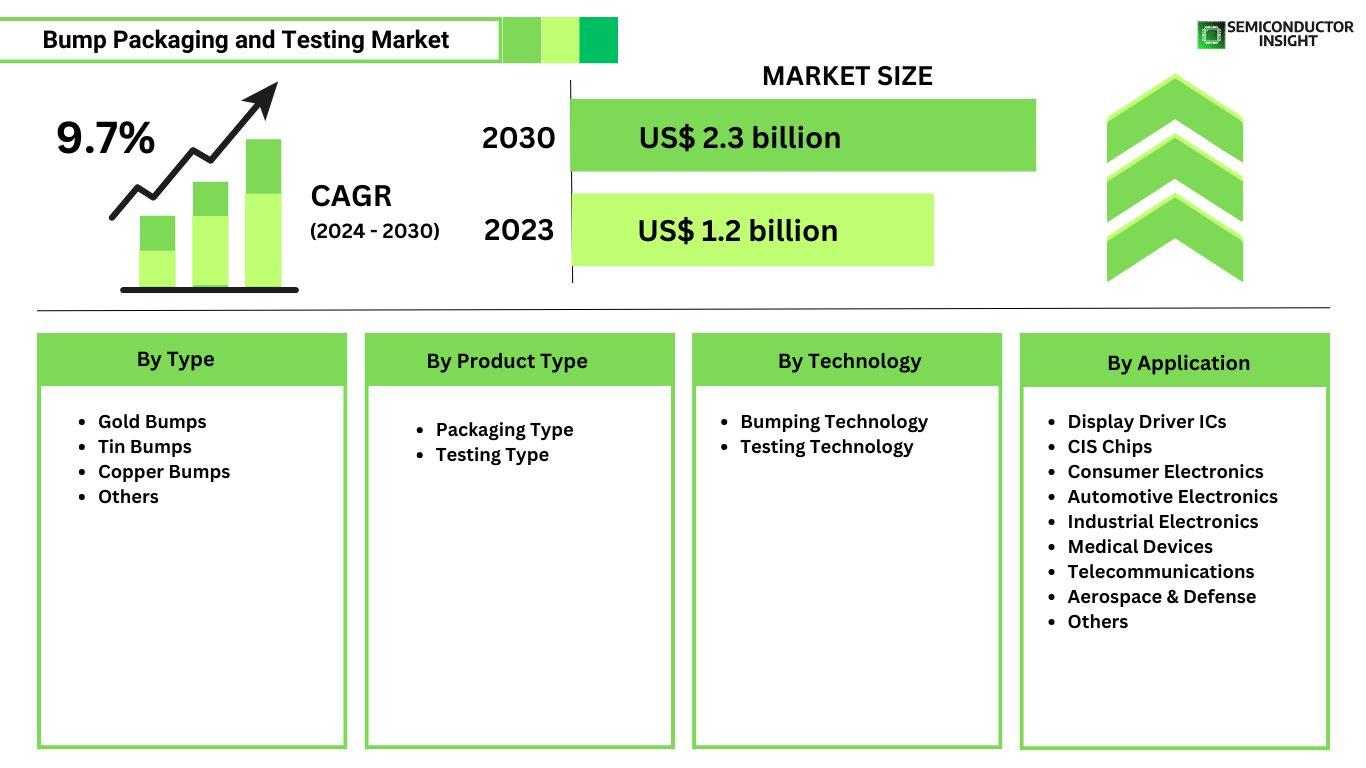

Global Bump Packaging and Testing Market was valued at USD 1.2 billion in 2026 and is projected to reach approximately USD 3.3 billion by 2034, expanding at an estimated CAGR of around 9.7% during the forecast period 2026–2034. Market expansion is being driven by rising demand for high-density semiconductor packaging, advanced wafer-level interconnects, and performance-critical integrated circuits across consumer, automotive, industrial, and communications applications.

Bump packaging and testing refers to the ecosystem of technologies and services used to develop and validate bump interconnections in semiconductor devices. These microscopic conductive bumps — typically formed using gold, tin, or copper — enable high-reliability electrical connections between semiconductor dies and substrates. Testing processes verify bump integrity, electrical continuity, and long-term reliability, ensuring performance in advanced packaging architectures.

Full report access:

https://semiconductorinsight.com/report/bump-packaging-and-testing-market/

Bump Packaging and Testing Market Forecast 2026–2034 Shows Strong Growth Global Bump Packaging and Testing Market was valued at USD 1.2 billion in 2026 and is projected to reach approximately USD 3.3 billion by 2034, expanding at an estimated CAGR of around 9.7% during the forecast period 2026–2034. Market expansion is being driven by rising demand for high-density semiconductor packaging, advanced wafer-level interconnects, and performance-critical integrated circuits across consumer, automotive, industrial, and communications applications. Bump packaging and testing refers to the ecosystem of technologies and services used to develop and validate bump interconnections in semiconductor devices. These microscopic conductive bumps — typically formed using gold, tin, or copper — enable high-reliability electrical connections between semiconductor dies and substrates. Testing processes verify bump integrity, electrical continuity, and long-term reliability, ensuring performance in advanced packaging architectures. Full report access: https://semiconductorinsight.com/report/bump-packaging-and-testing-market/0 Commenti 0 condivisioni 10 Views

Altre storie